Deeply knowing the cost of acquiring new customers is crucial for gauging the effectiveness of your marketing strategies and ensuring long-term profitability.

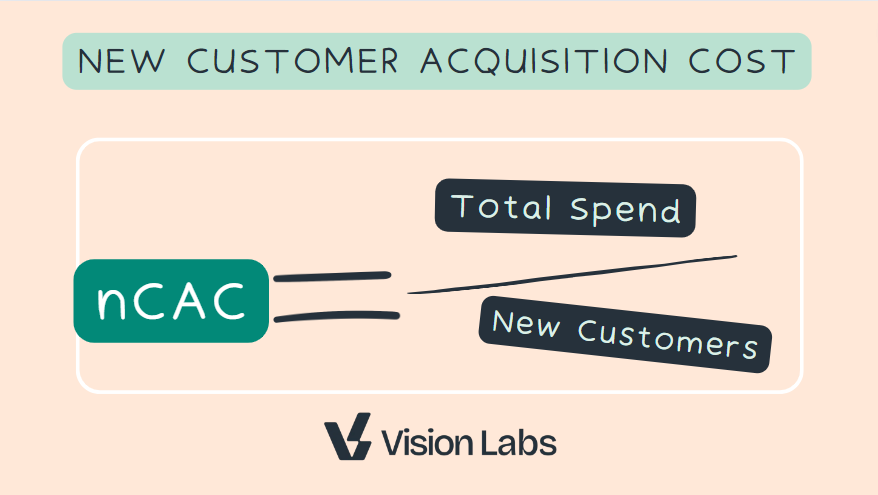

This metric, known as New Customer Acquisition Cost (nCAC), is a subset of the broader Customer Acquisition Cost (CAC) and provides specific insights into the expenses associated with attracting new customers.

What is New Customer Acquisition Cost (nCAC)?

New Customer Acquisition Cost (nCAC) measures the cost involved in acquiring a new customer through marketing efforts.

It is a more focused metric than the general CAC as it exclusively considers the expenses incurred in attracting new buyers, rather than including the costs associated with retaining existing customers.

Importance of Segmenting Customer Acquisition Costs

Segmenting total customer acquisition costs into nCAC and the cost to retain existing customers (rCAC) provides a clearer picture of where marketing funds are going and how effectively they are being used.

For instance, if the overall CAC is $10 but the nCAC is $25, it indicates that acquiring new customers is more costly than retaining existing ones, which could lead to strategic shifts in marketing spend.

How to Calculate nCAC? Formula Included

To compute New Customer Acquisition Cost (nCAC), divide your total marketing spend by the number of new customers acquired during that period.

Here’s a straightforward example to illustrate:

// Assuming a marketing spend of $10,000 resulted in 400 new customers

totalSpend = 10000;

newCustomers = 400;

let nCAC = totalSpend / newCustomers; // $25 per new customer

This calculation shows that each new customer cost $25 to acquire, which is a critical figure for evaluating the efficiency of marketing campaigns targeted at new customer acquisition.

New Customer Acquisition Cost (nCAC) Calculator

We’ve made a New Customer Acquisition Cost (nCAC) free online calculator to help you quickly measure how much it costs to acquire new customers over a specific period.

With our free online calculator, you can easily track your nCAC and make data-driven decisions to optimize your customer acquisition strategy and maximize profitability.

For those seeking a more comprehensive solution of ecommerce metrics, VisionLabs offers custom dashboards that reveal your profit drivers, backed by expert strategists who turn data into action – all without the hassle of building an in-house team. If you want to know more, check our ecommerce data services

nCAC Ecommerce Examples

Let’s break down how nCAC calculations might differ depending on the platform you use to track and manage your data:

Google Analytics 4 (GA4)

In GA4, tracking nCAC involves integrating your ad spend data and filtering it to focus only on new customers. By analyzing conversion events for first-time purchases, you can attribute a portion of your marketing spend to these new users.

Shopify

Shopify provides insights into your customer segments. By pulling data on new customer orders, and matching that with your ad spend (through platforms like Facebook Ads or Google Ads), you can calculate your nCAC directly within Shopify’s analytics dashboard.

Meta (Facebook) Ads

On Meta, you can segment campaigns specifically designed for new customer acquisition. Use naming conventions for campaigns targeting new users, and calculate the spend associated with these campaigns to arrive at your nCAC. For example, if you spent $5,000 on a campaign and acquired 200 new customers, your nCAC would be:

nCAC = 5,000 / 200 =$25

Why is nCAC Important to Marketers?

Understanding nCAC allows businesses to:

- Adjust Marketing Spend: Allocate budget more efficiently by targeting the most cost-effective channels and tactics for acquiring new customers.

- Set Performance Benchmarks: Use nCAC as a benchmark to optimize marketing campaigns and improve the return on investment (ROI).

- Evaluate Profitability: Compare nCAC against the lifetime value (LTV) of a customer to assess the long-term profitability of acquiring new customers.

Lifetime Value (LTV) Consideration

An essential aspect of assessing nCAC is comparing it to the Lifetime Value (LTV) of a customer. Ideally, the LTV should be significantly higher than the nCAC to ensure profitability. For example:

let LTV = 120; // Average lifetime value of a customer

let ratio = LTV / nCAC; // LTV to nCAC ratio

// A ratio of 4:1 indicates healthy profitability

A higher LTV to nCAC ratio signifies that the revenue generated from a customer far exceeds the cost to acquire them, indicating a sustainable business model.

Go Use nCAC Correctly on a weekly basis

Weekly reviewing your nCAC, will lead your company to ensure that marketing efforts are not only successful in attracting new customers but also in contributing positively to the overall financial health of the business.

Regularly reviewing this metric and adjusting strategies accordingly plays a crucial role in maintaining a competitive edge and achieving long-term growth.

How to Improve nCAC and Boost Ecommerce Profitability

Improving your nCAC is all about optimizing your marketing spend and reducing costs per new customer. Here are some actionable strategies:

- Optimize your ad targeting: Refine your audience targeting on platforms like Meta and Google Ads to focus on users most likely to convert.

- Use retargeting: Retarget users who have interacted with your brand but haven’t converted yet. These warm leads often have a lower nCAC.

- Experiment with different channels: Diversify your marketing channels to find the most cost-effective platform for new customer acquisition.

- Leverage A/B testing: Continuously test and optimize your creatives, copy, and landing pages to drive down your acquisition cost.

- Monitor and adjust bid strategies: On platforms like Meta, use Cost Control features such as bid caps to ensure you don’t overspend.

Benchmarks: What’s a Good nCAC in Ecommerce?

Determining whether your CAC is healthy hinges on two key factors: how it compares to the Lifetime Value (LTV) of your customers and the industry or product category you operate in.

A critical metric to monitor is the LTV to CAC ratio. For sustainable growth, your LTV should significantly exceed your CAC. For example, if you're spending the same amount to acquire a customer as you expect to make from them over their lifetime (a 1:1 ratio), your business won’t be profitable.

Ideally, you should aim for a much higher ratio, where the revenue generated from a customer far surpasses the cost to acquire them. Many successful businesses strive for an LTV to CAC ratio of at least 3:1 or higher.

However, the right CAC also depends on the nature of your product, margins, and industry. Products with high margins or high-ticket items may tolerate a higher CAC because the profit potential from each customer justifies the upfront investment. On the other hand, businesses with lower margins or more commoditized products will need to maintain a lower CAC to ensure profitability.

Knowing benchmarks specific to your industry and product type is essential for setting realistic goals. Ecommerce businesses often face different acquisition costs depending on their market, and aligning your CAC with industry standards can help gauge whether your marketing efforts are efficient or need adjusting.

nCAC vs. CAC

While nCAC focuses on the cost of acquiring new customers, Customer Acquisition Cost (CAC) encompasses the total cost of acquiring both new and existing customers.

For example, if you spent $10,000 and acquired 1,000 customers in total (both new and returning), your CAC would be $10:

CAC = 10,000 / 1,000 =$10

However, if only 400 of those were new customers, your nCAC would be higher:

CAC = 10,000 / 400 =$25

This distinction helps marketers make more informed decisions, especially when it comes to allocating resources between acquiring new customers and retaining existing ones.

FAQs

What’s the difference between CAC and nCAC?

CAC includes both new and returning customers, while nCAC only considers the cost of acquiring new customers.

How often should I review nCAC?

It’s best to review nCAC regularly, such as weekly or monthly, to ensure your marketing efforts are cost-effective and align with long-term profitability goals.

What’s a good nCAC to LTV ratio?

A 3:1 ratio is a solid benchmark. If your LTV is $90, your nCAC should be no higher than $30 to maintain profitability.

Understanding your nCAC allows you to make smarter marketing decisions, optimize spend, and ultimately grow your business in a sustainable way.