Free New Customer Acquisition Cost (nCAC) Calculator

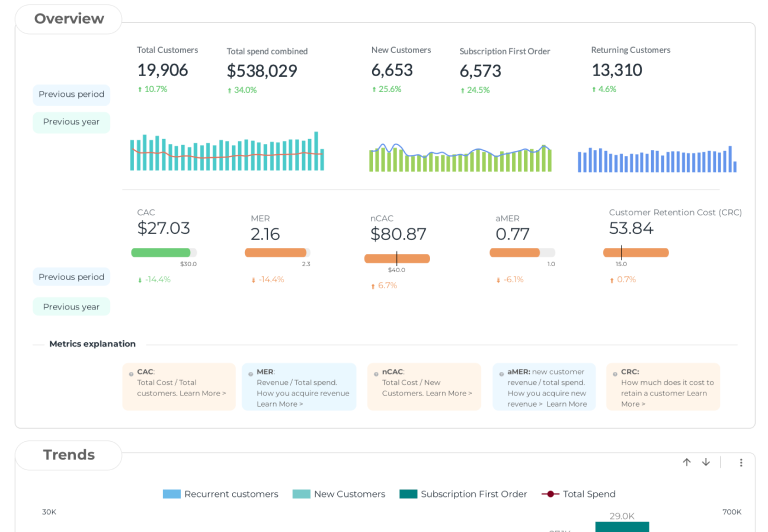

Calculate your New Customer Acquisition Cost (nCAC) with this online tool. Discover how much you’re spending to acquire new customers, gain insights into your marketing efficiency, and benchmark against industry standards to inform your customer acquisition strategies.

Calculate your New Customer Acquisition Cost (nCAC) ⬇️

Discover how Vision Labs can help you optimize your marketing spend and reduce your New Customer Acquisition Cost!

Visit VisionLabs.com/contact to learn how we can help you.

Talk soon,

JJ Reynolds

Founder | Vision Labs

What is a good New Customer Acquisition Cost (nCAC)?

While ideal nCAC varies by industry and product type, here are some general guidelines:

- For ecommerce: Aim for an nCAC that’s 1/3 of your customer Lifetime Value (LTV).

- For SaaS: A good benchmark is 1/3 to 1/5 of your Annual Contract Value (ACV).

Remember, context is key. Use these figures as a starting point and adjust based on your specific business model and profit margins.

When analyzing your nCAC, here are some recommendations to make your data actionable:

- Compare to Customer Lifetime Value (LTV): Ensure your LTV is significantly higher than your nCAC for long-term profitability.

- Analyze trends over time: Look at how your nCAC changes month-to-month or quarter-to-quarter. Is it increasing, decreasing, or stable?

- Break down by marketing channel: Calculate nCAC for each acquisition channel to identify the most cost-effective methods.

- Segment by customer type: Different customer segments may have varying nCACs. Identify which segments are most cost-effective to acquire.

- Compare to industry benchmarks: How does your nCAC stack up against competitors in your industry?

How to calculate Repeat Purchase Rate in ecommerce? Formula included

To Calculate nCAC, follow these steps:

- Choose a specific time period (e.g., 30 days, 2 months)

- Sum up all marketing expenses aimed at acquiring new customers

- Count the number of new customers acquired in this period

- Divide total marketing spend by number of new customers

- The result is your nCAC

nCAC Formula: nCAC = Total Marketing Spend / Number of New Customers Acquired

Example of calculating nCAC:

- Time period: April 1 to June 30 (Q2)

- Total marketing spend: $75,000

- New customers acquired: 1,500

- nCAC = $75,000 / 1,500 = $50

Result: In Q2, it cost an average of $50 to acquire each new customer.

What is New Customer Acquisition Cost (nCAC)?

New Customer Acquisition Cost (nCAC) calculates the expense of bringing in a first-time buyer through marketing initiatives. This metric is more specific than the broader Customer Acquisition Cost (CAC), as it focuses solely on the resources spent to attract newcomers, excluding any expenses related to keeping current customers.

For example, if you spend $10,000 to acquire 1,000 customers (both new and returning), your CAC would be $10. However, if only 400 of those are new customers, your nCAC would be higher at $25.

FAQ's

How to improve New Customer Acquisition Cost?

Improving your nCAC involves optimizing marketing spend and reducing costs per new customer. Here are some actionable strategies:

1. Optimize Ad Targeting: Refine audience targeting on platforms like Meta and Google Ads to focus on users most likely to convert.

2. Use Retargeting: Retarget users who have interacted with your brand but haven’t converted yet, as these warm leads often have a lower nCAC.

3. Experiment with Different Channels: Diversify marketing channels to find the most cost-effective platform for new customer acquisition.

4. A/B Testing: Continuously test and optimize your creatives, copy, and landing pages to drive down acquisition costs.

5. Monitor and Adjust Bid Strategies: Utilize cost control features on ad platforms to ensure you don’t overspend.

How Does nCAC Relate to Customer Lifetime Value (LTV)?

A key consideration in assessing nCAC is its relationship with the lifetime value of a customer (LTV). Ideally, LTV should be significantly higher than nCAC. For instance, if the LTV is $120 and the nCAC is $25, the business has a healthy profit margin.

JJ Reynolds

JJ Reynolds is the founder of Vision Labs, a white-label data agency specializing in custom measurement systems and real-time marketing dashboards. Having worked with startups to multi-billion dollar companies, he creates bespoke reporting solutions that help businesses turn data into decisions. His expertise in media buying, PPC, and analytics enables companies of all sizes to make smarter, data-driven choices.

All Marketing calculators

Get notified immediately as new calculators & strategies are launched

Join 6,000+ D2C Brands, Marketers, & Analysts who want to act on their data