Customer Lifetime Value (LTV) Calculator

Calculate your ecommerce Lifetime Value (LTV) with this online calculator. Discover the average value each customer brings to your business by accounting for both revenue and costs over their entire relationship, giving you a clear picture of their real contribution to your bottom line.

Customer Lifetime Value Calculator

Avg. LTV at 90-days is: $0

- 0-30 days LTV: $0

- 0-60 days LTV: $0

- 0-90 days LTV: $0

Optimize Your LTV

To optimize your business strategy using Customer Lifetime Value (LTV) analysis, focus on three key areas:

- Customer segmentation

- Acquisition cost efficiency

- Retention strategies

Segment customers based on their LTV to tailor marketing efforts. Compare LTV to Customer Acquisition Cost (CAC) to assess ROI, aiming for an LTV:CAC ratio of at least 3:1.

How to use this LTV ecommerce calculator?

To use this calculator follow this steps:

- Input Revenue per Purchase ($):

- Enter the average revenue generated from each purchase. In the example, it’s set to $60.

- Input Cost per Purchase ($):

- Enter the average cost associated with fulfilling each purchase, including COGS and shipping. In the example, it’s $20.

- Input Customer Acquisition Cost (CAC) ($):

- Enter the average cost of acquiring a new customer. In the example, it’s $45.

- Input New Customers:

- Enter the number of new customers acquired. In the example, it’s set to 400.

- Input Number of Purchases for Each Period:

- 0-30 days: Enter the number of purchases made by new customers in the first 30 days. The example shows 400.

- 31-60 days: Enter additional purchases made by the same customer cohort of new customers between 31 and 60 days. The example shows 10.

- 61-90 days: Enter additional purchases made by the same customer cohort of new customers between 61 and 90 days. The example shows 20.

- Review LTV Results:

- The calculator will display LTV results for each time period (0-30 days, 0-60 days, and 0-90 days) based on your inputs.

What is a good Customer Lifetime Value benchmark?

A strong Lifetime Value (LTV) varies depending on the industry, but typical benchmarks for e-commerce suggest targeting a 30% increase in LTV within the first 90 days and a 100% increase by the end of one year. In other words, a customer should ideally double their initial value to the business over the course of a year.

For example, if a customer’s first purchase is $60, their LTV should ideally grow to $78 by the 90-day point and $120 by the end of 365 days.

When analyzing Lifetime Value (LTV), here are some recommendations to make your data actionable:

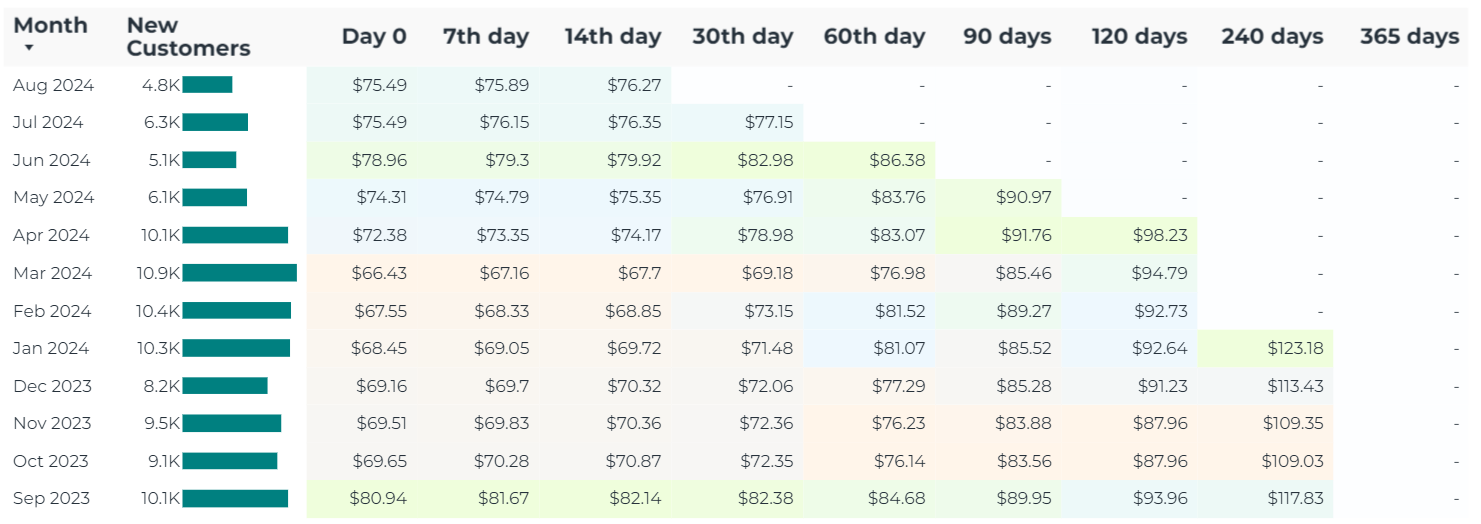

- Use Cohort Analysis: Group customers by their first purchase date and track LTV growth over specific intervals (e.g., 30, 60, 90, 365 days). This allows for “apples to apples” comparisons and helps identify trends in customer behavior.

- Monitor Purchase Frequency: Track how often customers make repeat purchases. Analyzing purchase frequency helps pinpoint opportunities to encourage more frequent buying behavior.

- Track Average Order Value (AOV): Assess AOV alongside LTV to see whether customers are spending more per order over time, providing insights into the effectiveness of your pricing and product strategies.

- Compare to Customer Acquisition Cost (CAC): Ensure your LTV is at least three times higher than your CAC to maintain healthy profit margins. A higher LTV relative to CAC means you can invest more in acquiring new customers while staying profitable.

- Optimize Product Offerings: Focus on products that drive repeat purchases, such as consumable items, to naturally increase LTV.

- Enhance Customer Experience: Provide top-notch customer service to foster loyalty and repeat purchases, driving up LTV.

- Implement Upselling and Cross-Selling: Introduce customers to complementary or premium products to increase overall spending.

- Develop Loyalty Programs: Create rewards or promotions for repeat buyers to boost retention and improve LTV.

How to calculate Customer Lifetime Value in ecommerce? Formula included

To calculate LTV, follow these steps:

- Choose a specific time period that represents the average lifespan of a customer (e.g., 1 year, 3 years).

- Calculate the Average Order Value (AOV) by dividing the total revenue by the number of orders during that time period.

- Determine the Purchase Frequency by dividing the total number of orders by the total number of unique customers.

- Multiply AOV by Purchase Frequency to find the average annual revenue per customer.

- Multiply by Customer Lifespan to get the total expected revenue from a customer.

- Subtract the Customer Acquisition Cost (CAC) to find the real contribution of a customer.

LTV formula = (Average Order Value (AOV)×Purchase Frequency)×Customer Lifespan

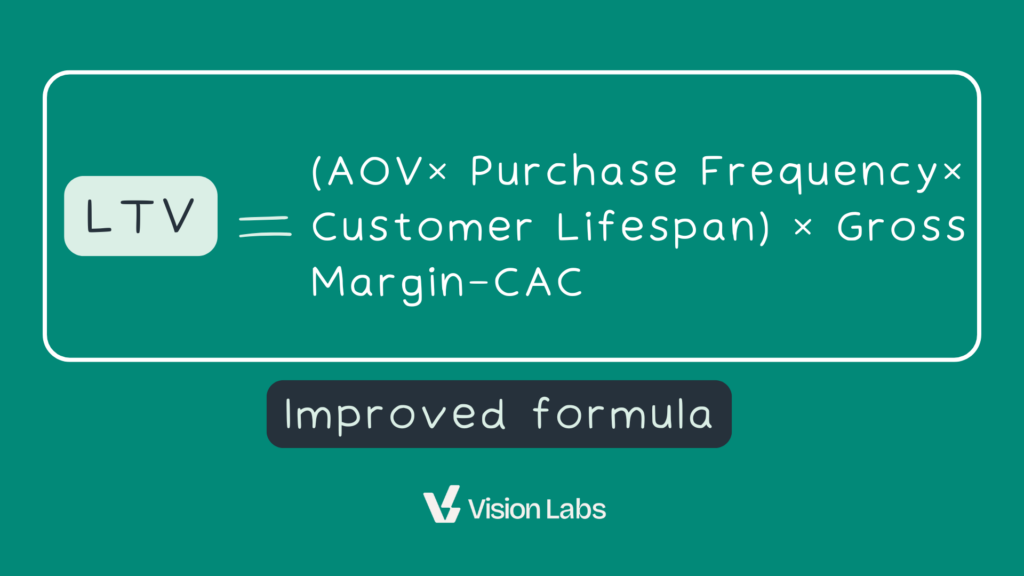

You can refine the LTV by including Gross Margin to represent the actual profit more accurately

LTV extended formula =(AOV×Purchase Frequency×Customer Lifespan)× Gross Margin−CAC

This formula provides a clearer view of how much profit you can expect from a customer throughout their relationship with your business, after accounting for costs.

What is New Customer Lifetime Value (LTV)?

LTV is the total contribution a customer makes to your business over the duration of their relationship. In simpler terms, it’s the sum of the profits generated from a customer’s purchases, minus the costs of acquiring and serving them.

We calculate Lifetime Value (LTV) by including costs because it reveals the real contribution of a customer to the business. Factoring in expenses like Customer Acquisition Cost (CAC) and Cost of Goods Sold (COGS) allows us to determine the actual profit generated, not just the revenue, providing a true understanding of customer value.

FAQ's

How does customer lifetime value impact overall profitability?

Customer Lifetime Value (LTV) has a significant impact on profitability in several ways:

Guides Customer Acquisition Spending: LTV helps determine how much a business can afford to spend on acquiring customers. A higher LTV allows for greater investment in customer acquisition while maintaining profitability.

Assesses Long-Term Profitability: LTV measures the total value a customer contributes over their entire relationship with a business, helping companies focus on strategies that increase customer value over time.

Supports CAC Comparison: Comparing LTV to Customer Acquisition Cost (CAC) is crucial for ensuring profitability. Ideally, LTV should be at least three times higher than CAC to maintain healthy profit margins.

Indicates Retention and Loyalty: A higher LTV often signals better customer retention and loyalty, which boosts profitability through repeat purchases and reduced marketing costs.

Informs Business Strategy: Understanding LTV helps businesses optimize marketing strategies, product offerings, and customer service to focus on long-term profitability rather than short-term gains.

Calculating LTV Using Cohort Analysis

To analyze Lifetime Value (LTV) by cohort, follow these steps:

Group Customers by Cohorts: Create cohorts based on the date of customers' first purchases. For example, all customers who made their first purchase in January form one cohort, while those who started in February form another.

Track Purchase Frequency: Measure how often customers in each cohort make purchases over time.

Calculate Average Order Value (AOV): For each cohort, determine the average amount spent per order.

Consider Costs: Deduct associated costs from the revenue to calculate the profit (or contribution) per customer.

Aggregate and Analyze Over Time: Track how the LTV of each cohort grows over specific intervals, such as 30, 60, 90, and 365 days.

Project Future Value: Use the data to forecast potential LTV for new customers based on past cohort performance.

JJ Reynolds

JJ Reynolds is the founder of Vision Labs, a white-label data agency specializing in custom measurement systems and real-time marketing dashboards. Having worked with startups to multi-billion dollar companies, he creates bespoke reporting solutions that help businesses turn data into decisions. His expertise in media buying, PPC, and analytics enables companies of all sizes to make smarter, data-driven choices.

All Marketing calculators

Get notified immediately as new calculators & strategies are launched

Join 6,000+ D2C Brands, Marketers, & Analysts who want to act on their data